What Is It?

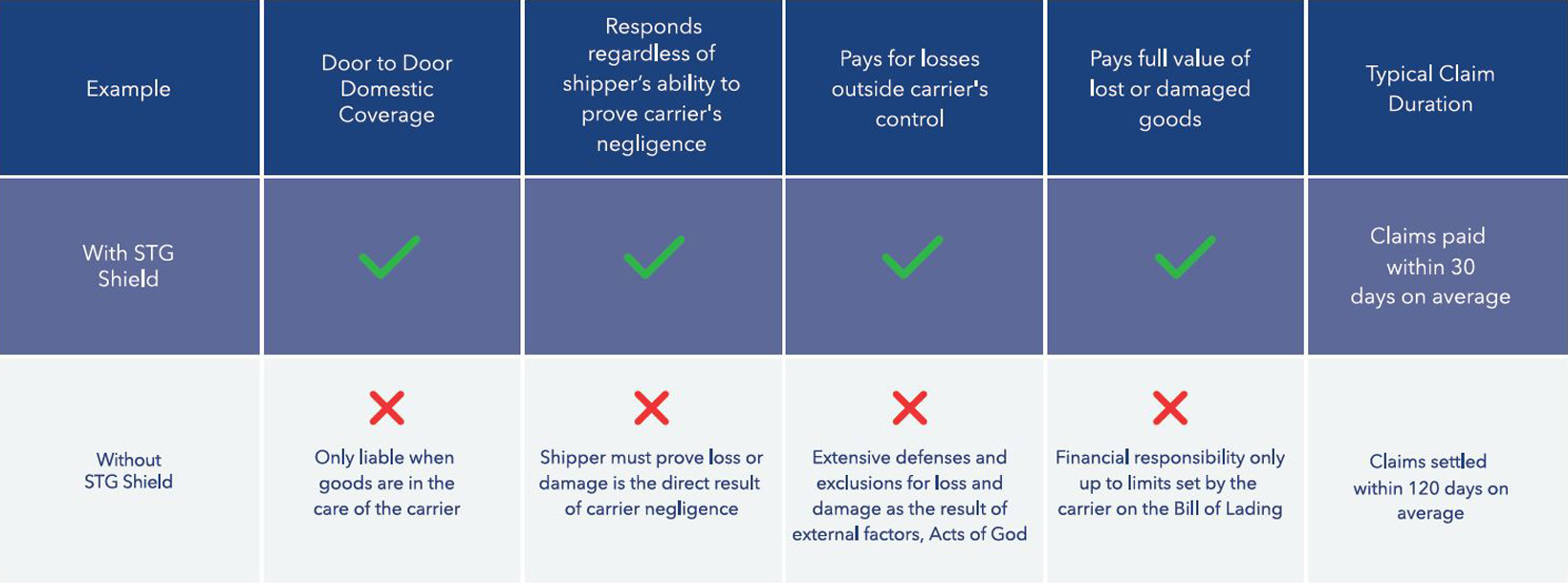

Carriers legally have limited liability riddled with exceptions when it comes to cargo damage. This limits the customer to accepting something other than actual insurance coverage often resulting in a long claim process and receiving a payment that is a fraction of the actual loss.

STG Shield is a first-party policy protecting your goods for up to their stated value in the event of physical loss or damage in transit.

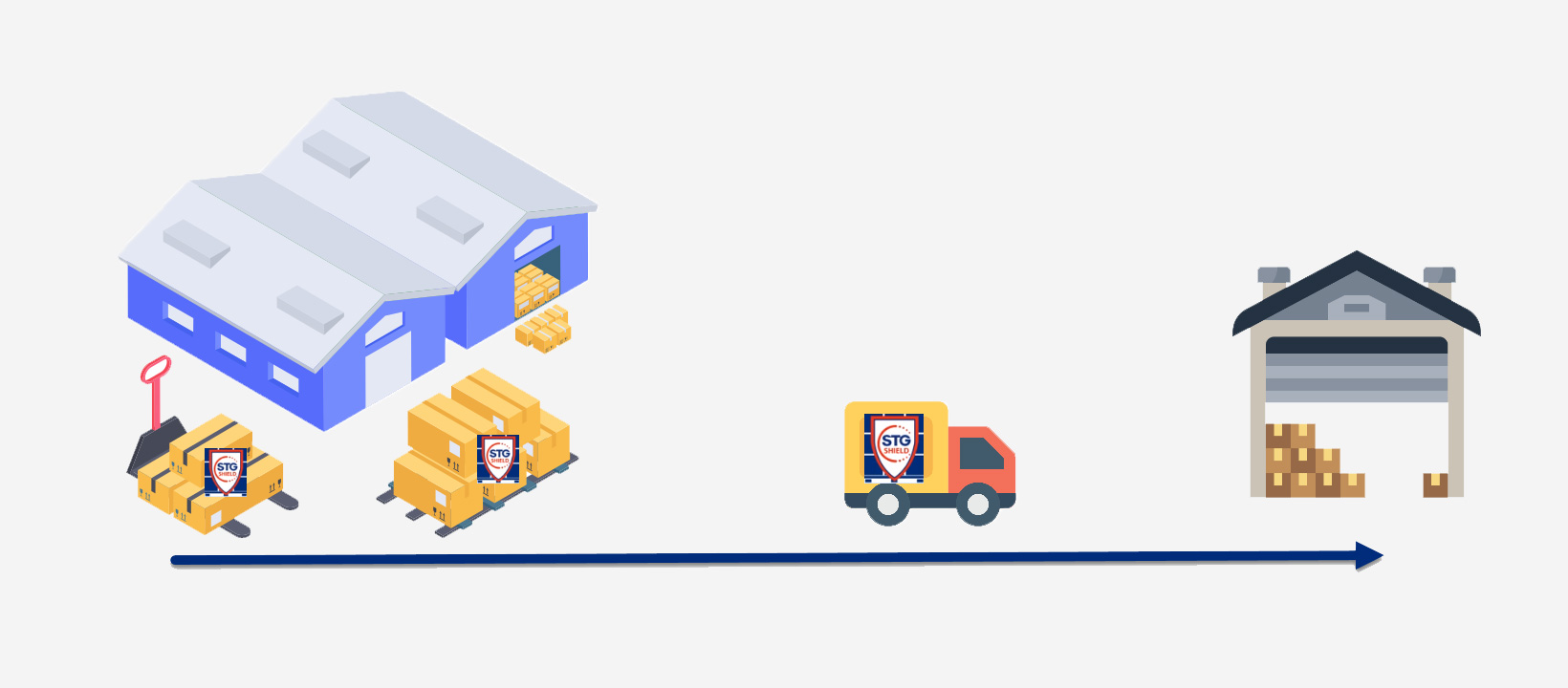

The base door to door domestic insurance coverage is $10,000 with zero deductible. STG Shield responds regardless of shipper’s ability to prove carrier’s negligence, pays for losses outside carrier’s control and it pays full value of lost or damaged goods.

The pick up location has to be an STG location for the shipment to be covered. In regards to IPI shipments, coverage is from an STG location to another STG location.

For example:

- IPI shipment from LA to KAS is not covered, because the pick up location is Kansas and it is not an STG location.

- IPI shipment from LA to HOU is covered, because the pick up location is Houston and it is an STG location.

If the shipment ends at any of the locations specified in the document below, insurance coverage is valid.

The Benefits of STG Shield

Actual Protection from Risk for your Freight

Get best in class coverage with STG Shield at a lower cost than declaring excess value coverage with Carriers. STG Shield provides the broadest coverage available for losses in and outside of the Carrier’s control.

Hassle-Free Claims Experience

Provides peace of mind and prompt payment in the event of claims. Avoid the headaches of dealing with Carriers. Claimed works directly with adjusters to quickly settle claims in 30 days or less from notice.

Peace of Mind

Loss happens. With STG Shield, you have a better experience with prompt attention to settlement in protection against both unpaid and underpaid losses.

Affordable

Coverage is economical for the protection you deserve saving you from financial loss and expense.